Is the global economy teetering on the brink of a new era of trade wars? The escalating trade conflict between the United States and China, marked by punitive tariffs and retaliatory measures, has ignited a firestorm of economic uncertainty and threatens to reshape the landscape of international commerce.

The already tense situation deteriorated further on Friday morning, as Beijing escalated its response, hiking tariffs on U.S. goods to a staggering 125 percent. This latest move follows a series of escalating actions, signaling a deepening rift between the world's two largest economies. The implications are far-reaching, with the potential to destabilize markets, disrupt supply chains, and ultimately, slow down global economic growth. The ripple effects of this conflict are being felt across the globe, prompting anxieties among businesses, policymakers, and consumers alike. China's Ministry of Finance has not yet released a full statement on the recent rise in tariffs, but the decision is viewed as a direct response to earlier actions taken by the United States.

| Aspect | Details |

|---|---|

| Core Issue | Escalating Trade War between U.S. and China |

| Key Players | United States, China, Canada, Mexico, European Union |

| Tariff Actions |

|

| Affected Sectors |

|

| Economic Impact |

|

| Geopolitical Implications |

|

| Timeline |

|

| Date and Location |

|

| Trade Volume |

|

| Retaliatory Measures |

|

| Trump's Stance and Actions |

|

| Chinese Stance and Actions |

|

| Links | Reuters - Trade War Escalates |

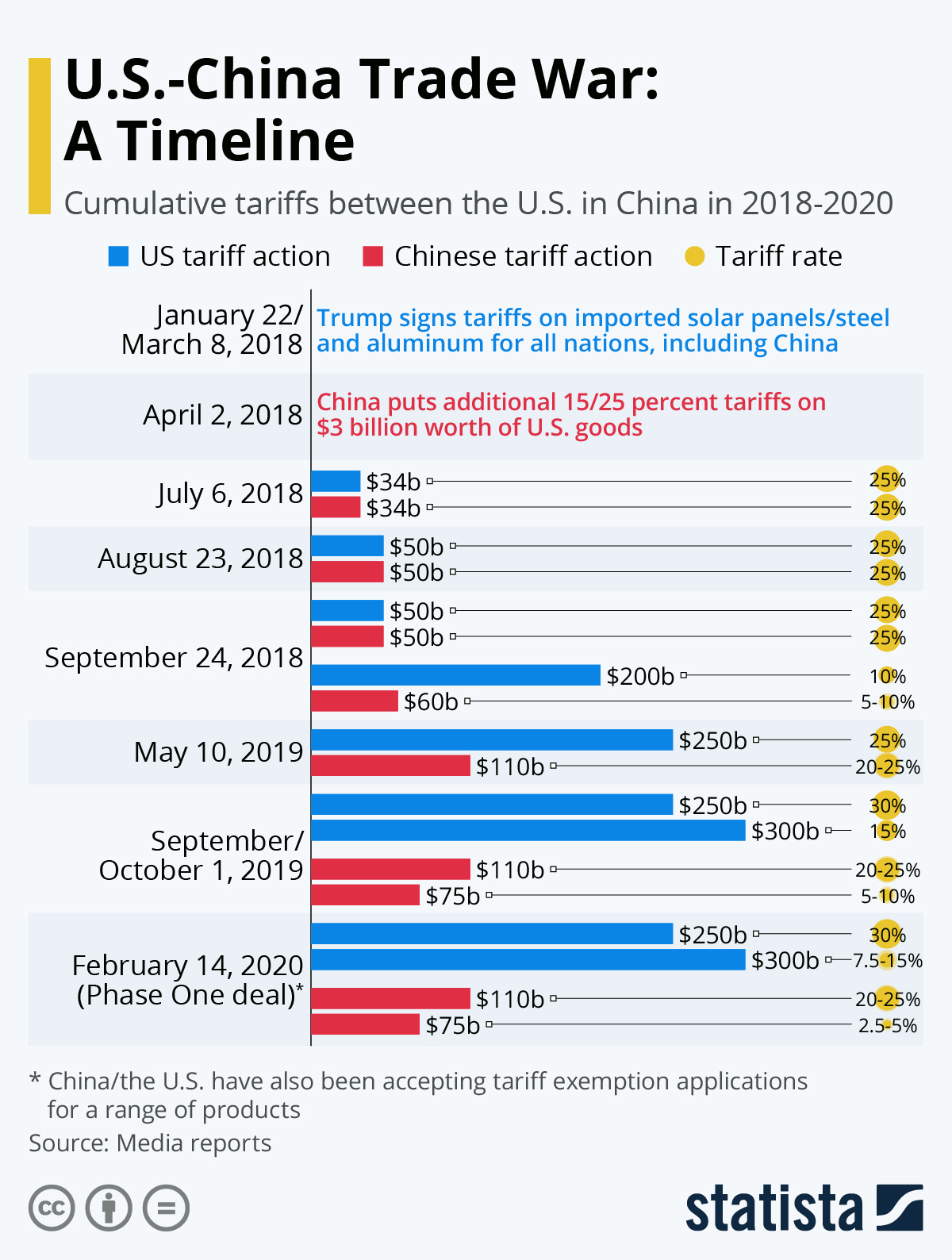

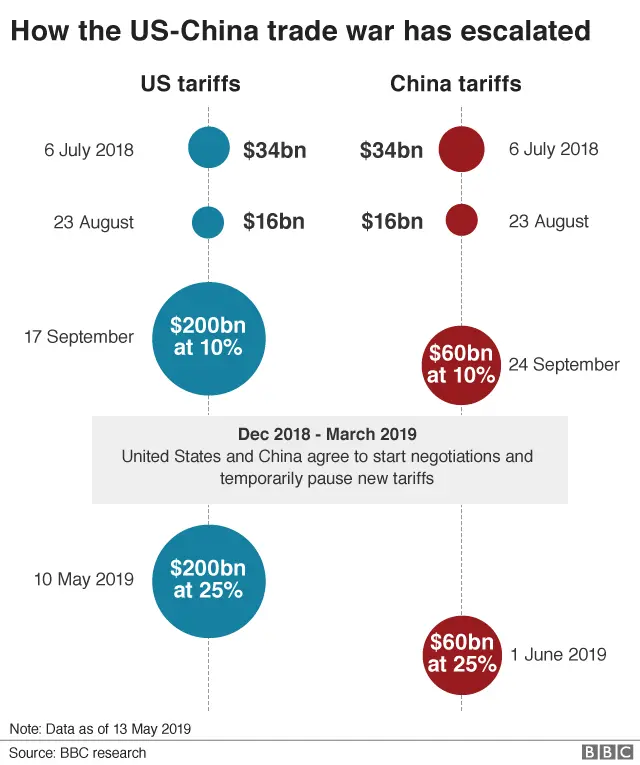

The escalation marks the latest in a series of tit-for-tat actions between the two economic giants. The United States, under the leadership of President Trump, initiated the trade war with China, imposing tariffs on various Chinese goods. China, in turn, responded with its own set of tariffs on U.S. products. This cycle of reciprocal measures has intensified over time, leading to increased uncertainty and a palpable sense of anxiety within the global market. The repercussions are also evident in the shifts within the supply chains.

China's Ministry of Finance, in a swift response to U.S. actions, implemented retaliatory tariffs on approximately $22 billion worth of U.S. goods, particularly targeting agricultural exports. This strategic move aimed to apply pressure on President Trump's base of support, particularly those residing in rural areas, and highlights the politicized nature of the trade conflict. This deliberate targeting underscored the high stakes involved and the increasingly complex dynamics of the trade dispute.

The economic stakes are incredibly high for both nations. The U.S.-China trade relationship is one of the most substantial in the world. For China, the gains from trade with the United States have been "tremendous," contributing significantly to the country's economic growth. The benefits are also flowing in the opposite direction, and the U.S. purchases millions of cars, tremendous amounts of food and farm products from China, alongside various other products and services.

The impact on international trade relations is undeniable. As new tariffs on imports from China, Canada, and Mexico took effect, the trade war intensified. Chinas move to increase the tariffs, and in turn, U.S.s response to the increase in the tariffs from China, highlights the deep-seated tensions and the willingness of both sides to utilize tariffs as a key tool in their trade strategy. This move has not only rattled markets but has also initiated global market reactions and supply chain disruptions, causing significant instability and affecting the world's economy.

China's response was swift and decisive. China retaliated, announcing 84% tariffs on goods it imports from the U.S. This reciprocal action is a clear indicator of the escalating tensions. China is a leading trading partner of the U.S. and 14% of imported goods (measured by value) are sourced from China. The substantial volume of trade between the two nations means that any disruption has the potential to significantly affect the global economy.

The overall trade volume between the United States and China underscores the significance of their economic relationship. U.S. total goods trade with China stood at an estimated $582 billion in 2024, with a trade deficit of $295 billion, which is 5.8%. This enormous trade imbalance reflects the intricate interdependence of the two economies. The trade war's effect on these existing trade dynamics could have extensive consequences.

The effects of the trade war are already evident in several areas. The trade war has led to a decline in U.S. export volumes to China. The volumes of liquefied natural gas (LNG) exports dropped by 59.8% and car shipments fell by 33% since 2021. These declines reflect the impact of tariffs and other trade barriers on specific industries. This situation adds to the economic challenges faced by companies and industries that have a strong presence in this trading area.

Furthermore, companies are finding themselves in difficult situations, particularly those reliant on supplies from China. The decision by China to restrict exports of some metals used in semiconductors and electric vehicles has sent shockwaves through the industry. As a result, companies have rushed to secure alternative supplies, signaling the significant shifts occurring in global supply chains. This includes finding alternatives to materials that China has restricted for export, highlighting the significant supply chain issues caused by the trade war.

The implications for consumers are also considerable. A rise in tariffs leads to an increase in the prices of imported goods, which can then be passed on to consumers. This, in turn, may lead to a decrease in consumer spending and a possible slowdown in economic growth. The question is how this will influence the decision-making process of consumers. The rise in tariffs has the potential to impact the everyday lives of consumers, influencing the cost of everyday items.

The trade wars impact on global supply chains is also apparent in the recent events. In a stark illustration of escalating tensions, Beijing imposed broad tariffs on imports of American food and said 15 U.S. companies could no longer buy from China without limitations. This move suggests that the trade war is morphing, and its impact is going beyond just tariffs. The restrictions on the companies buying practices is a sign of further tension.

The threat of further escalation looms large. President Trump has stated that tariffs on the European Union (EU) could be imposed "soon," citing the EU's perceived unfair trade practices. This statement indicates that the trade war could expand beyond China and encompass other key trading partners. A similar course of action in other countries would also have detrimental impacts on international trade.

Chinas retaliatory tariffs on $14 billion in U.S. goods are now in effect, adding to the growing financial pressure on American exporters. These retaliatory tariffs signify the seriousness of the situation and the determination of China to respond to the U.S. trade actions. The effect of these duties might be felt in a wide range of economic sectors.

Recent images from Wuhu, Anhui province, China, which captured containers and cargo ships at a port on February 4, 2025, illustrate the importance of trade in the global economy and the potential for disruption. These visuals highlight the potential for economic disruption as well as the growing scale of the global trade war.

The trade war's impact has also been observed during Trumps first term, which involved a lot of negotiations, but also led to increased tensions. The U.S. tariffs on Chinese goods and possible benefits to India were also discussed. These actions by Trumps administration set the stage for current developments and underscored the long-term implications of the trade dispute.

In a bid to stabilize the situation, U.S. President Donald Trump paused the implementation of 25% tariffs on Mexico and Canada just hours before they were scheduled to take effect. This demonstrates the complex dynamics and high stakes involved in the negotiations. This action underscores the need for flexibility and dialogue amidst the tensions.

In Beijing, China, on April 9 (ANI), China released a white paper criticizing the U.S. for imposing tariffs on over $500 billion worth of Chinese exports since 2018, calling it a form of economic coercion. This paper provides a comprehensive overview of China's stance and its critical view of the U.S. trade actions. It also highlights Chinas grievances with U.S. trade policies. This further illustrates the widening divide in the international economic arena.

The potential for further escalation remains. President Donald Trump has threatened an additional 50% tariff on Chinese imports unless China retracts its recent 34% tariff increase on U.S. goods by April 8. This raises the possibility of raising total U.S. tariffs on Chinese products to 104%. The threat of more tariffs underscores the need to resolve the situation quickly to avoid more economic damage. It indicates the possible future outcomes and the intensity of the confrontation.

The trade imbalance between the United States and China is striking. In 2023, the U.S. imported $427 billion worth of products from China, while it exported only $148 billion worth of products to the market. This imbalance has been a source of contention and a key driver of the trade war. These numbers give us an insight into the economic dynamics and the areas of contention.

China's economy has significantly benefited from its trade relations with the United States. This economic relationship has led to the creation of millions of jobs in China. This reflects the significance of the bilateral relationship for China's economic growth. This economic dependency poses a challenge for the two countries as they deal with trade disputes.

The United States has historically been a leading exporter to China, alongside Japan, South Korea, and Taiwan. These key exporters have played a vital role in China's economic growth. This demonstrates how trade relationships have contributed to the global economy.

In a strong signal to the trade war, President Donald Trump on Monday warned that if China does not roll back its recent 34% tariff hike by April 8, the United States will impose an additional 50% in tariffs on Chinese goods, effective April 9. This demonstrates the ongoing confrontation and shows the direction of the trade war.

While China opts for a measured response, it leverages the situation to strengthen global trade ties. This action may involve exploring and expanding trade relationships with other countries to counter the negative impacts of the trade war. China aims to build a resilient global trading network.

The situation has intensified as Beijing retaliated against Donald Trumps decision. This included imposing duties on more than half of all Chinese imports by slapping new tariffs on $60 billion of American goods and scolding the U.S. president. These retaliatory measures show how China is responding to actions taken by Trump and highlight the magnitude of the trade conflict.

President Donald Trump delivered on his threat to hit Canada and Mexico with sweeping import levies and doubled an existing charge on China, spurring swift reprisals that plunged the world economy. These actions have already made a noticeable impact. The impact on the global economy needs to be considered.

The most recent developments, up to Wed Feb 5, 2025 02:29 am, indicate an ongoing escalation. This includes China suspending the soybean import licenses of three U.S. firms and halting imports of U.S. lumber. These actions are the latest in a series of measures.

The developments are a continuation of the trade war between the United States and China and include steps to stop normal economic and trade cooperation between China and the United States.

The events are a result of actions taken after the United States imposed additional tariffs. The escalating trade war is a major challenge, not just for the countries involved but for the world economy. The situation continues to evolve, and further actions will probably be taken.

Detail Author:

- Name : Kailyn Bartoletti IV

- Email : morissette.betty@franecki.com

- Birthdate : 1987-06-01

- Address : 65324 Michaela Plaza Stoltenbergview, ME 30907-2944

- Phone : (360) 571-3718

- Company : Homenick-Rice

- Job : Forming Machine Operator

- Bio : Id molestias iste aut libero ut corrupti reiciendis. Molestiae aut impedit aliquid optio ab sed. Vel sint iure repellendus qui et animi dolorem. Natus dicta blanditiis et fugit ut eveniet est dolor.